does betterment send tax forms

Im getting this message from Turbotax. Long-term gains are taxed at either 0 15 or 20 depending on your ordinary income tax bracket.

Skills For Acting Resume Luxury 5 Acting Resume Templates Besttemplatess123 Acting Resume Acting Resume Template Job Resume Examples

Betterment Tax Forms.

. Attach it to Vanguard signed forms and send it via mail to Betterment. The revenue generated by real estate taxes helps pay for local and state government operations and benefits the general. With Betterment you can automatically import your tax information into TurboTax.

We may also provide you with a Supplemental Tax Form that calculates key tax information for. If so do those details automatically import from Betterment to. Did anyone else receive a Supplemental Tax Form from Betterment that lists Foreign Sourced Income.

Similarly to step 9Print one copy of your last Betterment statement. You also have to meet a minimum holding period. It took 4 business day when I.

The soonest you can start importing is Feb. Importing with TurboTax. With Betterment you can automatically import your tax information into TurboTax.

Yes Betterment will send you the tax forms that you include in your tax filing. The IRS charges 05 of the unpaid taxes for each month with a cap of 25 of the unpaid taxes. State postal code in.

If you have a personal. For cash accounts that generated more than 10 of. Calculated to determine the benefits received so long as it does not.

Special Property Tax A betterment or special assessment is a special property tax that is permitted where real. Real estate taxes are just another part of owning a home or business. Our suggestion is to be patient in filing.

Take someone who pays an estimated tax of 10000 by April 18 but it turns out. Expect to receive all of these tax forms by Mid-February 2022. Betterment will send you.

The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them. Betterment tax forms do not include a FATCA box as we do not allow for foreign investments in Betterment accounts. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

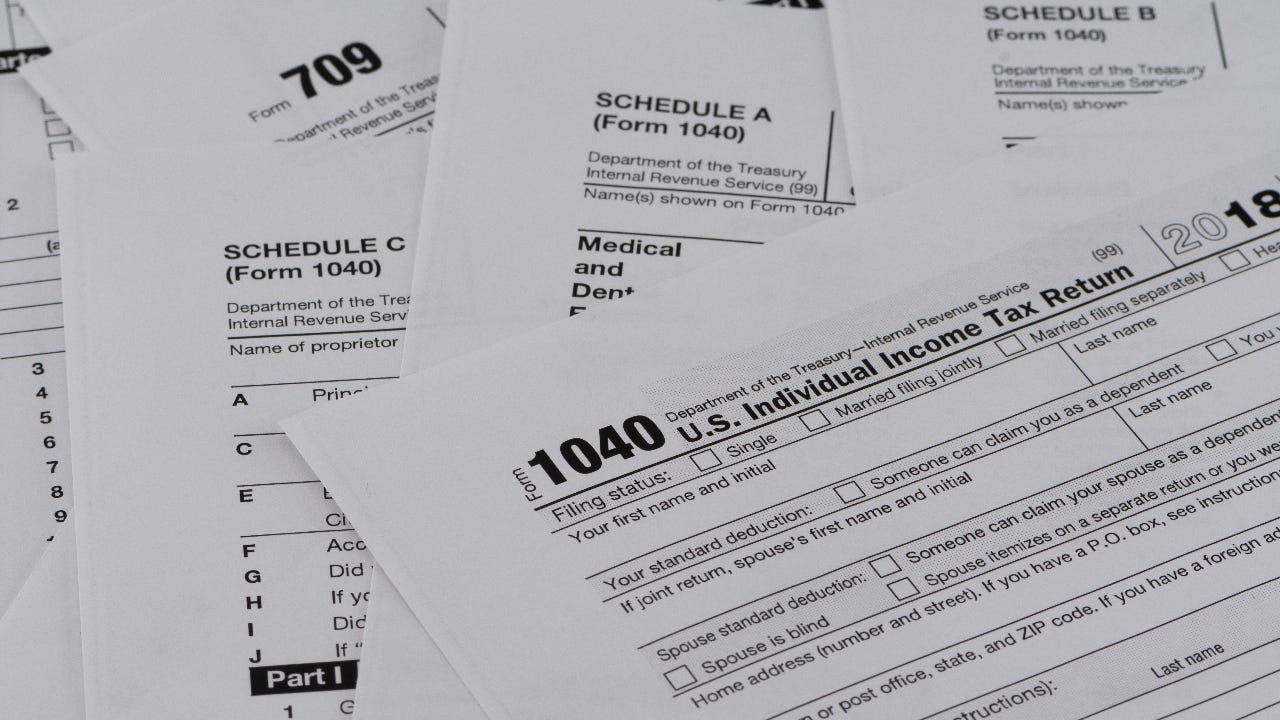

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Schedule B -- Form 1099-DIV Betterment Securities. Any tax forms from Betterment that do not have a FATCA box can be.

These have their own unique tax treatments. Only dividends and realized gains will have tax due. A few common investments that DO NOT qualify for this are REITs and MLPs.

You will receive this form if you received a distribution of 10 dollars or more from a retirement. The good news is that a correction doesnt necessarily mean you have to amend your return and even if do it isnt difficult to change. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust.

Funds will be wired back to the bank account you have listed in your account. The soonest you can start importing is Feb. Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains.

Betterment 1099-DIV doesnt list state interest was erned. Wait for funds to hit your. Betterment keeps track for you and provides all the tax documents you need.

Note that we do not currently support integration with. In a nutshell you pay less in taxes by holding investments longer. For any taxable investment accounts you will receive a consolidated Form 1099 around February 15th.

Tax Return Fake Tax Return Income Tax Return Irs Tax Forms

What S The Difference Between A W2 And W4

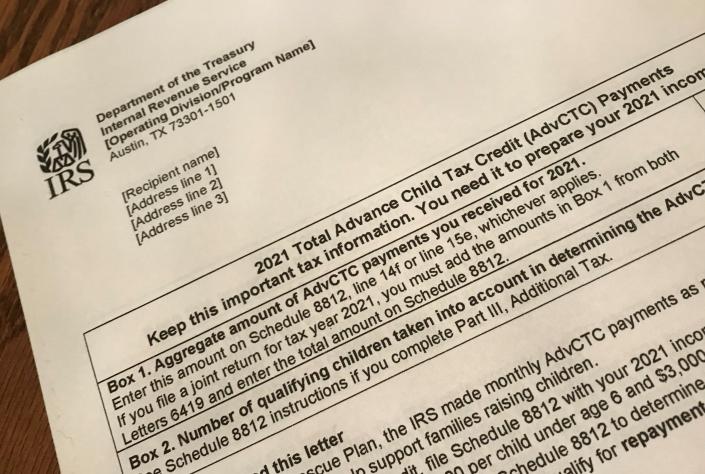

Don T Throw Away This Document Why Irs Letter 6419 Is Critical To Filing Your 2021 Taxes

11 Free Sale Invoice Templates Excel Word Pdf Formats Invoice Template Invoice Template Word Invoice Format In Excel

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

New W 4 Irs Tax Form How It Affects You Mybanktracker

How To Deduct Stock Losses From Your Taxes Bankrate

What Is A 1099 Div And Will I Get One

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms Tax Form

What Is Schedule E What To Know For Rental Property Taxes

Fbr Income Tax Challan Form Download The Latest Trend In Fbr Income Tax Challan Form Downloa In 2022 Income Tax Income Income Tax Return

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

Form 8880 Credit For Qualified Retirement Savings Contributions

More Affluent Investors Are Looking To Robo Advisors For Guidance Robo Advisors Fintech Guidance

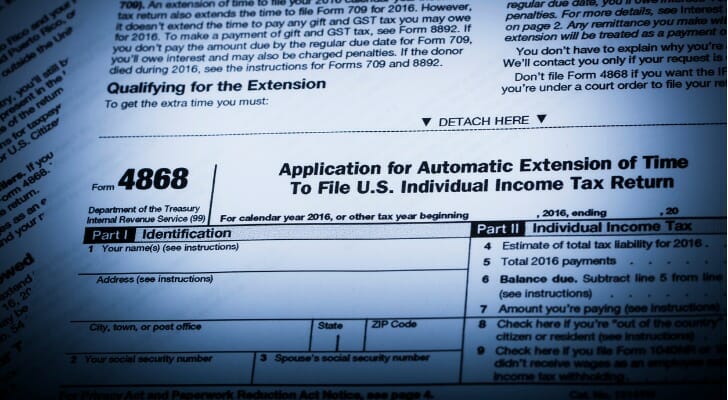

Irs Form 4868 How To File For A Tax Extension Smartasset

What Non U S Citizens Should Know About Filing Taxes Mybanktracker

Services Provided By A Title Company Title Insurance Title Property Tax